Climate shock to supply

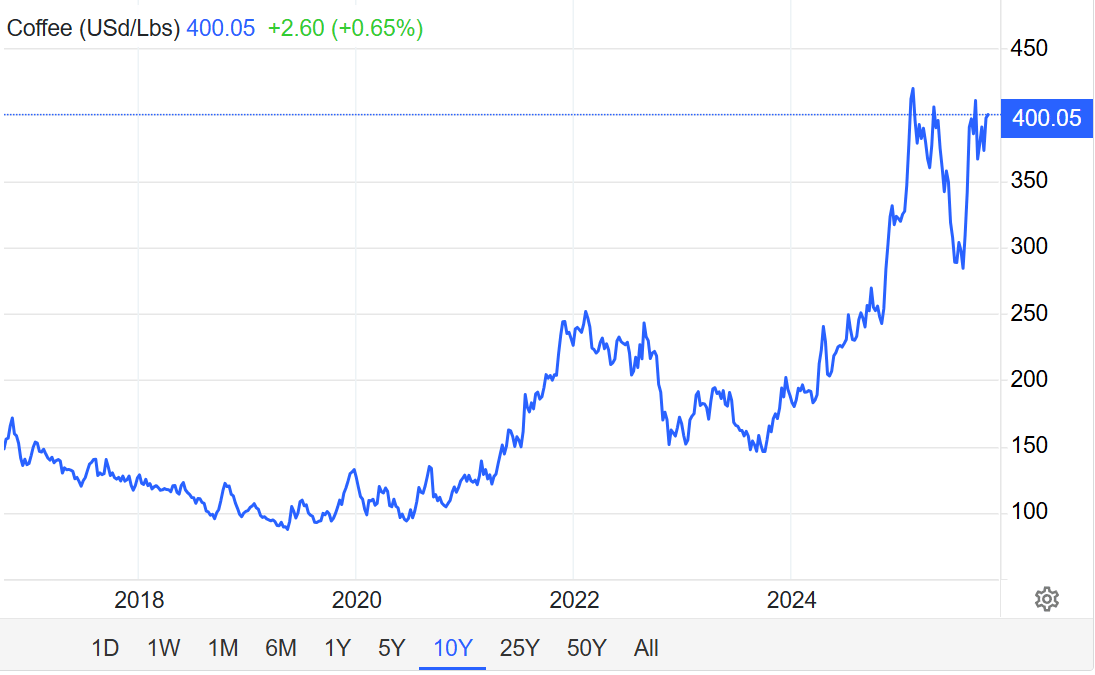

Global coffee prices have surged once again, underscoring the mounting vulnerability of agricultural commodities to climate volatility.

The benchmark arabica futures on the Intercontinental Exchange have risen sharply over the past weeks, driven by severe droughts and erratic rainfall in Brazil - the world’s largest producer - and unseasonal heat across Colombia and Vietnam.

Coffee Prices Reach New Highs as Climate and Supply Pressures Mount

These climatic anomalies, once seen as cyclical, are increasingly structural.

Prolonged dry spells in Minas Gerais and excessive humidity in key Central American regions have disrupted flowering and harvesting cycles, reducing yields and jeopardising bean quality.

The Intergovernmental Panel on Climate Change (IPCC) has long warned that suitable land for arabica could shrink by up to 50 per cent by 2050. Recent events suggest that this transformation may be unfolding faster than anticipated.

Economic Ripple effects

The consequences extend far beyond the plantation.

Coffee is one of the most traded commodity , and its price volatility reverberates through a complex global chain - from rural cooperatives to multinational roasters. As costs rise, major brands face a dilemma: absorb the shock to protect market share, or pass it on to consumers already fatigued by inflation.

Tariffs and shipping disruptions have compounded the pressure.

From Bean to Cup: The Global Coffee Supply Chain

Exporters in Brazil and Vietnam are contending with higher freight costs and trade bottlenecks that amplify price swings. Meanwhile, speculative trading has intensified, with investors viewing agricultural commodities as a hedge against broader market uncertainty.

Brewing future

The long-term viability of the coffee sector now hinges on adaptation.

Producers are experimenting with shade-grown cultivation, irrigation technologies, and climate-resilient hybrids developed through selective breeding. Yet these measures demand capital and institutional support that many developing economies struggle to provide.

For consumers, the price of a cappuccino may serve as a quiet indicator of a deeper economic realignment - one in which climate change is not a distant environmental concern but an active driver of global trade and inflation.

The World’s Coffee Capitals: U.S. Leads Global Consumption

Ready to dive into sustainable investing?

Subscribe to The Climate Mentor today to get updates on the latest trends, tips, and news on climate change.

Enjoy the newsletter? Please forward this to a friend 👥

It only takes 15 seconds. Making this took me 10 hours⌚